The Dangers of MMT: From Counterrevolution to Zimbabwe

Hang out for a bit of time amongst the soft left – being progressives and social democrats – discussing politics and current events and you will surely come across a certain monetary theory. Modern Monetary Theory, also known as MMT, is a mainstay of the soft left much like anti-circumcision activists, anti-vaxers, and militant vegans. Like these others, there is a small core of fierce proponents and a smaller contingent of soft proponents and those who accept them as a vital part of a coalition. Like the anti-vaxers, its proponents are highly damaging and their policies are highly counterproductive and outright dangerous.

The problem with MMT is not descriptive: it describes rather accurately a certain part of how monetary systems work in an age where there is no gold standard nor any other resource as a standard. Specifically, it says that government spending creates currency while taxation destroys it. This is accurate at least for the government that issues the currency – in the United States that means that it applies to the federal government but not to state and local governments.

This results in the fact that, with no central resource to reclaim, with all transactions being paper or electronic transactions, and the government having the ability to issue as much of its currency as it desires, money spent does not have to come from anywhere. Since this issuance of currency does not rely upon having anything in particular in reserve, taxation is not necessary in order to issue it and may be seen as destruction. A more balanced view may be that spending covered by taxation amounts to recirculation of funds, taxed currency not spent or explicitly in reserve is destroyed, and spending not covered by taxation is created – but MMT’s description is a technically accurate for an abstract commodity.

The problem with MMT is proscriptive: how people apply that information, especially to policy. Going with just this information, what ideas come to mind? Perhaps you will conclude that taxes do not pay for government services as L. Randall Wray of the University of Missouri – Kansas City claims. This may be poor wording on his part, as we will discuss later, because he disowns much of what people take from that statement. People run with this and decide that taxation is unnecessary, and often go down the wormhole and ascribe to the anarchocapitalist (ancap) rally cry that taxation is theft. However, before you go off concluding this is an argument for horseshoe theory ( that the far right and far left become the same, the far left – or hard left – does not suffer from this thinking, these are people who span from slightly to the right (progressives) to perhaps a third the way to the left from the ideological center (social democrats), not the far left.

When trying to advocate socialism, I’ve come across another problematic use of MMT. My calls for socialism were seen as irrelevant because class issues were irrelevant since the government can just give everyone a Universal Basic Income so large that we are all wealthier than we can imagine. It wouldn’t be hard to believe this person felt that everyone could stop working altogether and society would keep on trucking.

The depths of economics get reduced to “the government can just print whatever it needs” by the majority of MMT’s proponents. It has become a single issue philosophy that many view as a panacea for all societal ills. Aside from preventing action on serious issues that need to be addressed, if these ancillary ideas were applied to society as a whole, we would see a complete economic breakdown. We might see something worse than Zimbabwe.

A Brief History of Zimbabwe under Robert Mugabe

How people choose to apply MMT is so disastrous that I like to call it Mugabean Monetary Theory – though academically the theory is not so extreme as to warrant the name. Robert Mugabe was a revolutionary hero in the overthrow of Rhodesia, once a British colony and a largely unrecognized, independent, white supremacist state at the time. He was elected the first Prime Minister of the country under its renaming as Zimbabwe in 1980. An oddly praiseworthy start for one of the most inept rulers in world history.

He was a man who was for oppression of homosexuals and called himself the Hitler of the age due to his extreme nationalism. However, his legacy is that of the greatest inflation of a currency that the world has ever seen. One might call it superinflation, but that was too soft of a term and instead it is referred to as hyperinflation.

In 1980 you had a relatively modest 7% inflation rate which quickly doubled to 14% the next year and stayed relatively constant in the 1980s, though dipping back down to 7.3% in 1988. The early 90s saw higher than 40% inflation and settled back down to 20% in 1993, and stayed about the same until 1998. That year it broke 48% as in 1991 and then didn’t stop: it was over 50% the next year and over 100% two years after that in 2001. It was just shy of 200% in 2002 and just shy of 600% in 2003 and 2005. 2006 saw a 1,281.11% inflation and then 2007 had inflation of a staggering 66,212.3%.

However, this was all child’s play: Zimbabwe had reached an inflation rate of 231 million percent by July 2008. November 2008 was the peak with an inflation rate of 89.7% hexillion. Let’s put this in context.

Despite some difference in British and American definitions of these terms, the American version – as Forbes reported it – follows a specific pattern. You have thousands (10^3) – and a thousand thousands are a million (10^6). A thousand millions are a billion (10^9). A thousand billions are a trillion (10^12). A thousand trillions are a quadrillion (10^15). A thousand quadrillions are a quintillion (10^18). Finally, or at least as far as we need go, a thousand quintillions make a hexillion (10^21). The terms follow a regular pattern of prefixes referring to counting numbers of mono, bi, tri, quad, quint, and hex (The article actually uses the term sextillion, but both names are used for the number and hex is just a better root for 6 than sex – Clark Griswold roaming the streets of Germany asking for sex aside).

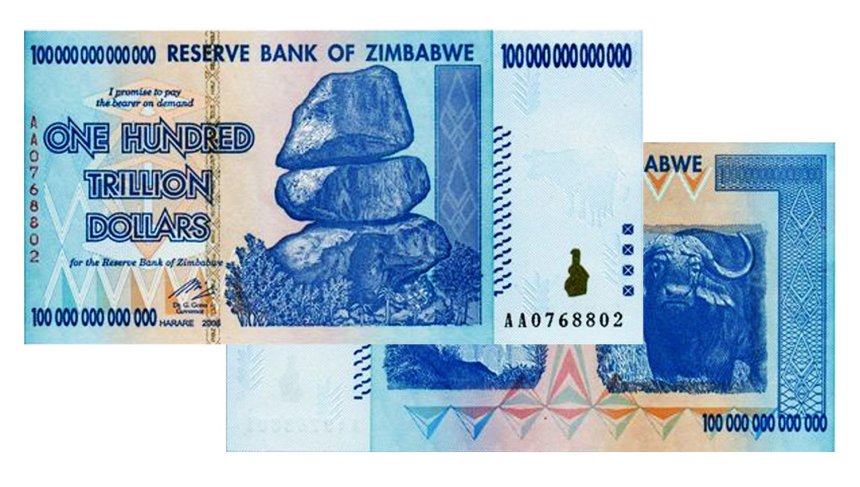

If you had a million Zimbabwean dollars on November 1, 2008, and that inflation rate held steady for the entire year, on November 1, 2009 it would be worthless: one 89.7 quintillionth of a dollar. A 100 trillion dollar note from that year would be worth one over 897 million dollars. In exchange, those notes are now worthless. However, I did find one selling for $158.45 and it might just sell due to its novelty factor.

The Z$100 trillion dollar note being sold by the Great American Coin Company

To have more fun with this, let us use Microsoft Excel to calculate the value of a Zimbabwean dollar in the course of a day in November 2008. I’ll use this suggestion from Microsoft:

Compound interest is the amount that a dollar invested now will be worth in a given number of periods at a given compounded interest rate per period.

Although Microsoft Excel does not include a function for determining compound interest, you can use the following formula for this calculation

=PV*(1+R)^Nwhere PV is present value, R is the interest rate, and N is the number of investment periods.

So, PV=1, R=8.97 *10^20 (a 100% rate would be referred to as 1, not 100), and N=1/366 (it was a leap year). This gives us a result that the Zimbabwean dollar is worth Z$1.14 the next day, losing 12.35% of its value. If we use 1/12 for N instead – using a whole month, you get it takes Z$55.73 the next month, losing 98.2% of its value.

These are inflationary rates where commerce cannot use the currency effectively. Let us say you took a job and agreed to what most would find a decent wage of $2000 biweekly – you work for two weeks and get paid 3 weeks later: it would take $32,347.81 at that date to get the pay you thought you agreed to be paid. You cannot save – you need to spend your money as soon as you get it lest it lose its value.

Now, Zimbabwe did not get here completely through printing off reams of useless currency as MMT proponents often suggest, but through a few other factors as well. However, these are not primarily those claimed by MMT proponents who wish to say the printing of money had no effect and in a very racist manner blame it on the redistribution of land from white landowners to black landowners. This began in 2000, 20 years after the revolution and after long periods of extremely high inflation. It also was part of a rare example where Mugabe had created systemic racism that did target white people in response to the earlier systemic racism that targeted the black majority. Through the inexperience of the black farmers – an inexperience created by previous injustices of colonialism – and fighting, agricultural output fell by about two thirds. However, even if this was the entirety of the Zimbabwean economy it would only account for an inflation rate of 200%, leaving an inflation rate still in the hexillions still needing accounting.

Rather, a lack of confidence in the currency drove further inflation. If the value of the currency is quickly degrading, those making in exchanges for the funds are going to take into account that degradation and charge more for their goods or services so that they have time to spend the money before it loses that value. That fuels inflation even further. Mugabe tried to control this through price regulation and requiring commerce use the Zimbabwean dollar, but that was unable to put a dent in this runaway inflation. Black markets for exchanging currency and trading in US dollars were abound and prices did not conform to regulation because the penalty for following the law would have meant impoverishment or even death.

Mugabe’s printing of money began much less extreme than many MMT proponents propose and yet he found himself forced to print so much more just to try to counteract the inflation leading the currency to become defunct (yes, that 100 trillion dollar bill is legally worthless and its only value is the novelty value and the slight utility value of art, toiletpaper, or kindling.

Yet, it was printing money wantonly that led to the inflation – Zimbabwe printed money to pay for things it wanted done, including financing a war, and to manage it’s debt. Though Zimbabwe could have continued to use its dollar and keep printing all it wanted, the effects of this application of MMT on Zimbabwean society made this untenable. The currency became insolvent not because more could not be printed to cover its debts, but rather because printing that money created a humanitarian crisis. People were starving, production fell, banks refused to loan money to anyone, it was untenable.

How Money Works

L. Randall Wray, whom we mentioned before, is clear that when he says that taxes do not pay for the government, this does not mean that wanton spending without taxation won’t have negative economic effects. He goes too far and yet not nearly as far as many people who will post his videos want to take things.

When he said that taxes do not pay for spending, he is working on a model that has a government printing money from nowhere and then taxing that same money. However, that is a reality that does not exist where he is applying it – the United States.

United States currency was started on the gold standard, and you could literally take your US currency in and exchange it for gold – the United States had gold (and actually still does – locked away in Fort Knox) and thus when it issued currency it was offering a promise of gold to people and when it taxed it was taking back this promise of gold. Wray is surely aware of this.

However, Richard Nixon took us off the gold standard and our money is backed completely by faith now – this is the world that Wray is supposing started US currency. Yet, the currency that the US began to tax after going off the gold standard was currency that was already issued under the gold standard. The US government did not have to spend before it could tax those same dollars – that is a myth.

Now, this doesn’t mean that Wray is completely wrong, but rather that his myth of how money originated – a myth that makes his argument very appealing – is shattered and we are left to deal with the argument itself without the dressing. And the argument itself is just that taxation reduces the money supply and spending increases the money supply – it is nothing more than that – neither that objectionable nor that particularly compelling. We are able to look at it rationally, not as revealed prophecy.

Before I jump to what that does actually mean, let us address the possibility of a government actually popping up from nowhere, without anything, which tries to issue currency. That takes some serious understanding of what currency is: a widely accepted item that serves as a promise for future goods and services. Certainly, bartering can be hard when all I have is pencils and the guy I want to get meat from isn’t interested in pencils – the intermediary allows me to get the meat in exchange for something that the guy I’m buying meat from can trade for whatever he wants, not just the pencils I possess.

Such a government would be spending by purchasing goods and services with something that the recipient can then go and give to others in exchange for other goods and services they need in turn. Because the third person, who gave none of their goods or services to the government in the first place needs some of these tokens to give back to the government, they accept them as payment. The government is not just getting back pieces of paper it issued, it was part of a long train of promises of goods and services. It is promising exchange of those goods and services and then calling back in proof that those promises were honored. It is not something useless at all.

So what does the base argument mean? Well, spending and taxation, in addition to their immediate effects, regulate the supply of currency in the economy absent the direct exchange for a specific good the government holds in reserve. Prices are based to a great extent on supply and demand – and essentially the value of a currency is based on the supply of that currency in circulation versus the value of goods and services which can be purchased with that currency or perhaps which effectively are purchased. So, if there is X amount of goods and services in the economy at a given moment and a quadrillion dollars, each dollar is worth one quadrillionth of X or one quadrillionth of the goods and services available.

Now, there is no completely accurate way to measure that – there is no centralized source logging every automotive vehicle as it is created and as it is scrapped – that measures every ounce of iron as it is used and as it is readded as scrap or mined from the Earth. Small aberrations, such as printing an extra sheet of dollar bills, is not going to measurably affect the economy at large. Measuring services becomes even more problematic because they don’t exist until they are rendered and yet their availability affects prices.

However, if the government printed enough money and issued everyone a billion dollars tomorrow, that will quickly cause inflation. Everyone is aware that there is a lot more currency, and if I have a billion dollars why would I be willing to shovel your sidewalk for $10 or sell you a car for $20,000? You can afford much more than that. If I had a billion dollars, perhaps I wouldn’t work for less than a million an hour. That money loses its value.

The population of the United States is approximated to be about 326.5 million in 2017, this means the government added about 326.5 quadrillion dollars – there is only $1.59 trillion in circulation currently. The money supply increased by (326,501.59 / 1.59) 205,000 times, this would be hyperinflationary. In fact, my settling wage of a million an hour only worked out to be worth about $5 an hour now, well below minimum wage.

Even if we all decided to ignore that there was suddenly a massively larger amount of currency out there, it would play out. How long until all that uneffectuated demand became effectuated? You go out, buy a sports car, TVs, and whatever other luxuries there are out there – they sell out quickly and with such higher demand, prices rise. I buy 6 TVs for $200 a piece, well I’ll resell them to those wanting them still at $30 million a piece – and I will find buyers because they should sell for $41 million. If economic collapse doesn’t happen, prices will be much higher in a week.

Now, let us say we just stopped taxation – $4.1 trillion is the White House’s planned budget for 2018, more than all the money in circulation. We might not see quite as high of an inflationary rate, but a (5.69/1.59) 360% of the currency existing would still have devastating effects. Destroying some currency is vital for economic security and stability – you cannot just print money and all is okay.

According to the US Treasury, as of January 21, 2018, the US owes $20,493,420,765,319.99 in debt. Basically, defaulting on the debt would create another astronomical hyperinflationary problem. We might start by saying that would be about five times as much as ending taxes, though that might be tempered by the fact that much of that debt is not owed to foreign governments, but also US citizens who own treasury bills. I know my retirement savings is all in treasury bills so as to avoid owning stock – which I find immoral – I’d lose my retirement.

It is vital for currency to both be created and destroyed in such a way to create at least a semblance of a balance in the dollar’s value so that we neither see massive inflation nor massive deflation.

The Bailout

One objection to this reasoning that MMT proponents have, and one which reasonably needs to be addressed, is that of the government bailout of the banks in 2 installments in 2008 and 2009. The first part of the bailout established TARP, it allocated $700 billion for the program – of which only $350 billion were ever disbursed – and the second part of the bailout and another $787 billion was issued by Obama. This totals almost $1.5 trillion and the question is why this did not prompt massive inflation.

Well, there are several reasons. First, the money was loaned, not spent. It created short term obligations for the money to be paid back. Second, there were restrictions placed on those who received the money, preventing firms from paying out shareholders or executive bonuses until the funds were paid back to the Federal Reserve.

In essence, the difference was made by the fact that the money wasn’t really in circulation – it existed theoretically to keep banks solvent, but it could not be issued out so that it really hit circulation and could affect the prices of anything. Had these restrictions not been in place, it likely would have caused a complete economic collapse of the United States.

How was the money used? Well, it seems that rather than lending it out (which may have caused massive inflation), the banks sat the money in the Federal Reserve garnering a quarter of a percent in interest – pulling free money out of the interest-free loan. According to a 2013 article by Matt Taibi, they never circulated most of it – we went from $2 billion stored at the Federal Reserve before the bailouts to $1.4 trillion sitting at the federal reserve – paying about $35 billion a year in interest. $35 billion has a much, much smaller effect than $1.5 trillion.

Were these bailouts corrupt and massive corporate welfare? Yes. Should they have caused inflation? Only if the funds were used appropriately might that have happened – misuse of the funds were the surest way that we avoided an inflationary catastrophe.

Deficits

Deficits are not necessarily problematic and that seems to be the main drive for MMT academically. If there is a slight inflation, that isn’t a huge problem – it can help people get out of debt and give them enough time to bargain for higher wages before they’re impoverished. If there is a 3% inflation rate, having a dollar today may only be worth 23 cents in 50 years, but it only falls to 97 cents next year so it is manageable. However, huge inflation destroys that security.

Going back to the White House’s budget, it leaves a $440 billion deficit even if the growth Trump expects miraculously appears. That’s 27.7% of the money we have in circulation now. We temper it with borrowing, but without that it would have a huge inflationary impact. Our current level of deficit spending is not sustainable long term and changes must be made – drastic changes. MMT is not a panacea for this – we cannot print our way out of it without horrific social costs.

The decisions to be made are not that tough, however. Trump’s proposed military budget is $643 billion (compared to $601 billion for domestic spending). This balloons to $722 billion by 2027 (compared to $429 billion for domestic spending). If we reference a Forbes infographic from 2016, we can see that cutting this amount by 2/3 would leave us comparable to China, by far the second largest spender on their military. Obviously, much of their spending is a direct result of our military spending and theirs would likely drop significantly if ours did as well. This would resolve $428.7 trillion of that $440 trillion deficit making the deficit manageable. Now, if we also taxed the rich like we should be doing, you will see a budget surplus, which can pay back our excessive debts down to a reasonable level and be used to invest in things that actually create economic growth (which tax cuts do not as I previously wrote) such as single payer or a national healthcare system which will keep workers healthy, free college tuition which makes a workforce skilled, or national jobs program that directly creates economic growth (i.e. goods and services).

Trying to fall back on MMT to avoid having to converse about what actually helps or harms the economy is nothing more than a delayed action time bomb ready to create even larger problems down the road. Efforts to explain why we don’t need to be spending the better part of a trillion dollars each year on killing brown people and force them to allow private corporations to take their resources, why the rich have to pay their taxes, how vital programs can be paid for by this that actually benefit the economy, and why your employer taking 2/3 the value of your labor is the real issue with your economic struggle are all waylaid for a myth that all problems are easily resolved by just printing money.

Progress is born of proper information, proper reasoning, and proper action – MMT is being misapplied in such a way as to destroy proper information and proper reasoning. While MMT need not be scrapped outright, its application must be reined in and used responsibly rather to fuel decisions based in reality rather than decisions based in fantasy. Some of its academic proponents seem to be doing this, but that is not at all true of its non-academic proponents.

Featured Image by Getty Images via National Public Radio. Fair Use

This work is unpaid because this is not a for-profit site. If you want to help support this work and more like it in the future, please consider becoming a patron of mine on Patreon on my page. Funds will not only help me transition to writing full-time but will allow me to purchase professional images for the articles.

I am a supporter of MMT and while she makes some great point THIS is NOT how I want our government to function in anyway. Bail outs and hope the money is misused so that it prevents inflation? That promotes corruption and she says it’s ok… bail them out and let them misuse the money because it is a good thing. That’s insanity:

Were these bailouts corrupt and massive corporate welfare? Yes. Should they have caused inflation? Only if the funds were used appropriately might that have happened – misuse of the funds were the surest way that we avoided an inflationary catastrophe.

Should we just ALLOW this to continue and say, “YEAH no inflation because they misused the money we GAVE them because we KNEW they would NEVER pay it back and not live up to the terms of the bailout. BUT we fooled them…hahahahahahaha”?

How is that different? Oh wait, the rich get richer and corruption is applauded.

LikeLike

I did not say the bailout was okay – I’m saying the fact that they misused it happened to assure that there was no inflationary disaster that may very well have happened otherwise. It’s still complete bullshit and shouldn’t have happened – we should have let them fail and the government should have taken over the financial industry. I made sure to say they were corrupt as a way of saying it was wrong they happened.

LikeLike

What a terrible article. You completely misrepresent what MMTers actually say, you misrepresent what happened in Zimbabwe and your macro-economic knowledge is woefully inadequate.

Dreadful, adolescent rubbish.

If you’re going to critique something, take the time to learn a bit about it.

LikeLike

I don’t think any responsible MMTer ever recommended giving everyone a billion dollars. That scenario’s hyperinflationary effects are obvious. Yet you wield that like a weapon against MMT. No responsible MMTer ever recommended stopping taxes either, and you don’t address the true purpose of taxes. And again, I’ve never heard of anyone suggesting that we not address economic ills and use MMT in some miraculous way to address those ills. If you know of someone that has suggested these things, please tell us who they are and we should try to properly educate them. Thank you.

LikeLike

That’s not what happened in Zimbabwe. He fired all the farmers, put revolutionaries in their place that didn’t know how to farm. Production went to hell quickly. Hyperinflation is caused by a shortage of goods. Just like ebay, if you have a rare item, people bid it up. But say you are selling something everyone else is also. Then say the govt give you an extra 1000 dollars. Are you going to pay more than asked for? NO. Creating money doesn’t cause inflation, a lack of goods and services. Your problem is obvious, you don’t really know MMT or you’re paid to bash it.

LikeLike